Author: iReadySites

-

The Ultimate Guide to the Right Broker Management System

A conversation with a potential client started all this. Client wanted a broker management system but didn’t know where to start. Following conversation will help you understand what a membership system is; especially for a small business finance company. Client: Question: Do you offer a website design that has a membership component to it as…

-

How to Choose the Perfect Website Design | 10 Tips

When choosing for the perfect website design, your primary goal is represent your mortgage brokerage in a professional manner. Your website serves as the entry point to your business. It can make or break your online presence. So what makes a great website? Here are the 10 essential features, every website must have. 1) Visually…

-

Step-by-Step On-Page SEO: Everything You Need For Guaranteed Rankings

On-page SEO (aka on-site SEO) is the process of optimizing mortgage website pages to rank higher in search engines to increase organic traffic. It focuses on optimizing page-level elements. These include meta tags, headings, subheadings, image tags, and page structure as well as content built around the search intent. Here, we’ll cover most important on-page…

-

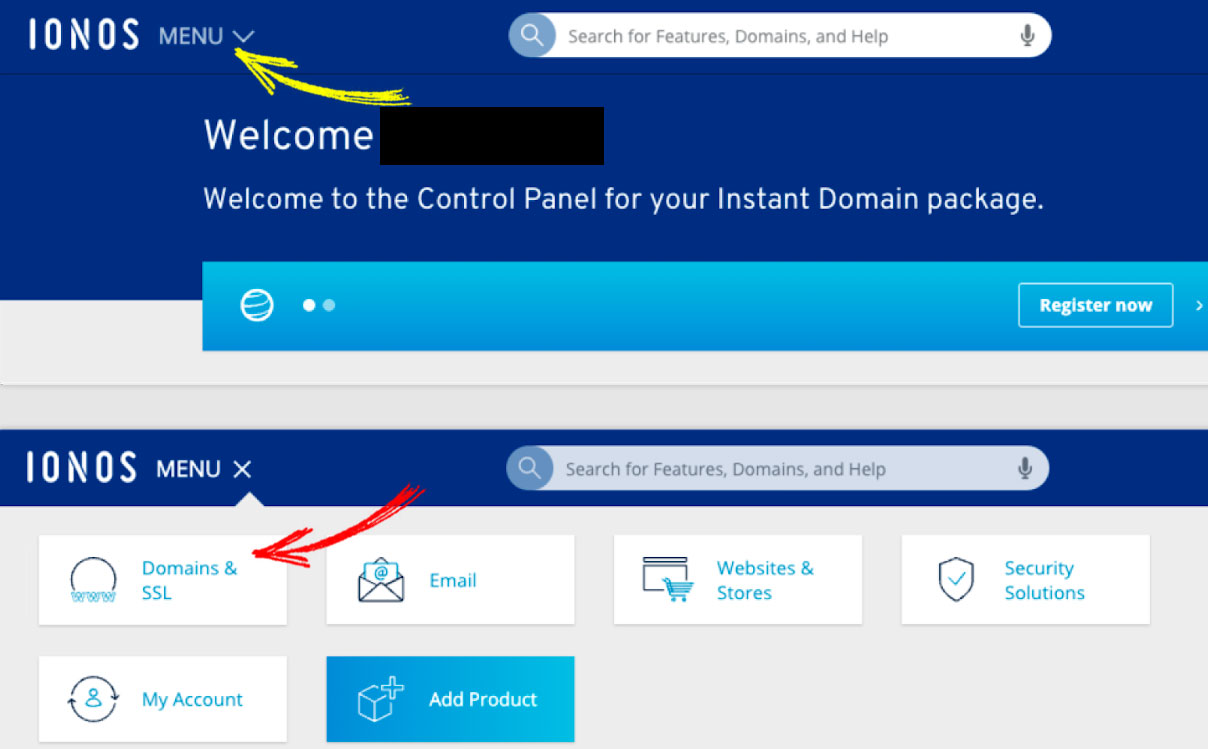

How To Connect a 1&1 IONOS Domain to Your Mortgage Website

Understanding how to point a 1&1 IONOS domain towards iReadySites hosting becomes crucial when you choose Monthly or Annual payment plans. This guide will present you with two common methods to point your domain to iReadySites. The first option uses nameservers, while the second method utilizes A records. By following the steps given below, you…

-

The Ultimate Guide to Effective Mortgage Flyers Marketing

Mortgage flyers are hands down one of the essential part of your marketing and communication. There is no doubt that digital marketing solutions (ads, social media and email marketing campaigns) are more of interest these days. However, if you reply solely on online mortgage marketing, you may miss out on the great potential that flyers…

-

20 Powerful Ways To Drive Traffic To Your Mortgage Website

If you want your business to flourish, you need a mortgage website designed and developed by professionals. And for a website to bring you leads day and night, you NEED traffic. The best part is, you really don’t have to spend a lot of money to generate a reasonable amount of targeted loan shoppers to…

-

The Best Mortgage Websites with Modern Web Design

The idea of shopping around for a mortgage can be daunting. Loan shoppers need to be assured that the mortgage company they are dealing with is reliable. And will take good care of their interests. A well thought off mortgage website can help potential customers trust your company by establishing your authority in the mortgage…

-

Free Mortgage Logo Designs: Inspiring Ideas for Your Company

We’ve created some amazing free mortgage logo designs for brokers, lender, loan officers and mortgage companies. If you are our client, you are welcome to choose a perfect mortgage logo design for your website. Use our pre-designed logo or contact us for a custom mortgage logo designed for your upcoming commercial mortgage website. You can…